The Basic Principles Of Fortitude Financial Group

The Basic Principles Of Fortitude Financial Group

Blog Article

Fortitude Financial Group for Beginners

Table of Contents5 Simple Techniques For Fortitude Financial GroupThe 30-Second Trick For Fortitude Financial GroupFortitude Financial Group for DummiesThe 45-Second Trick For Fortitude Financial GroupThe 9-Second Trick For Fortitude Financial Group

Basically, a financial expert assists people manage their cash. Generally, there is an investing part to their services, yet not always. Some monetary experts, typically accounting professionals or lawyers that specialize in trusts and estates, are wide range supervisors. One of their primary features is securing client riches from the IRS.And afterwards there are monetary experts who specialize in monetary preparation. Usually, their emphasis gets on educating customers and offering threat management, cash money circulation evaluation, retired life planning, education planning, spending and much more. To discover a monetary advisor who offers your area, try making use of SmartAsset's complimentary matching tool. Unlike lawyers who need to go to legislation school and pass bench or medical professionals who need to go to medical institution and pass their boards, monetary advisors have no details special demands.

Usually, though, a economic advisor will certainly have some type of training. If it's not via an academic program, it's from apprenticing at a financial advisory firm (Financial Services in St. Petersburg, FL). People at a firm that are still discovering the ropes are usually called partners or they belong to the management staff. As noted previously, though, many consultants come from other fields.

Or possibly a person that handles properties for an investment firm chooses they prefer to assist people and work with the retail side of business. Many monetary advisors, whether they currently have professional levels or not, experience certification programs for more training. A total economic expert certification is the licensed economic planner (CFP), while an advanced version is the legal monetary professional (ChFC).

Fortitude Financial Group Things To Know Before You Buy

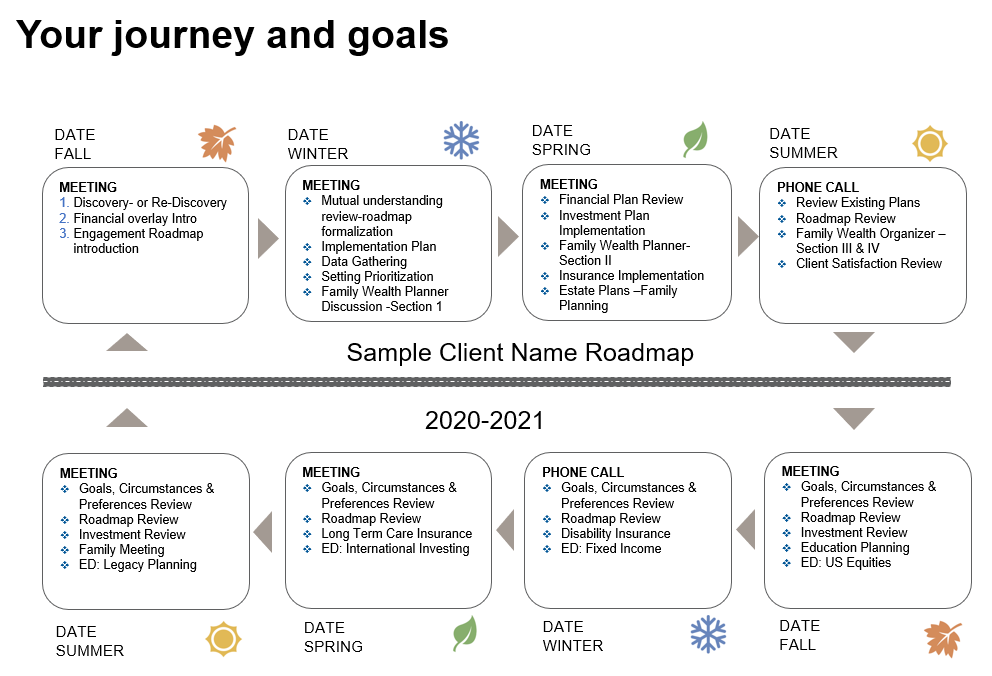

Typically, a monetary expert uses investment management, economic preparation or wide range management. This can be on a discretionary basis, which indicates the consultant has the authority to make trades without your authorization.

It will certainly information a series of steps to take to accomplish your economic objectives, including an investment plan that you can carry out on your very own or if you want the expert's aid, you can either employ them to do it as soon as or authorize up for ongoing monitoring. St. Petersburg Investment Tax Planning Service. Or if you have details requirements, you can hire the advisor for monetary preparation on a task basis

Their names typically state everything: Stocks licenses, on the other hand, are more regarding the sales side of investing. Financial advisors that are also brokers read this post here or insurance coverage representatives have a tendency to have safety and securities licenses. If they straight acquire or offer supplies, bonds, insurance products or provide monetary recommendations, they'll need specific licenses associated with those products.

The most prominent securities sales licenses include Series 6 and Series 7 classifications (https://my-store-fd7e1a.creator-spring.com/). A Series 6 license enables a financial expert to sell financial investment items such as mutual funds, variable annuities, device investment depends on (UITs) and some insurance items. The Series 7 license, or General Securities permit (GS), enables an advisor to sell most kinds of safeties, like typical and preferred supplies, bonds, alternatives, packaged investment products and even more.

The 25-Second Trick For Fortitude Financial Group

Always make sure to ask about economic experts' charge routines. A fee-only expert's single form of compensation is via client-paid costs.

, it's vital to know there are a selection of settlement techniques they may use. (AUM) for handling your money.

Based on the aforementioned Advisory HQ research, prices typically range from $120 to $300 per hour, typically with a cap to just how much you'll pay in total. Financial advisors can get paid with a repaired fee-for-service version. If you want a basic economic plan, you might pay a flat charge to get one, with the Advisory HQ research study showing ordinary prices differing from $7,500 to $55,000, depending upon your asset rate.

Some Of Fortitude Financial Group

When an advisor, such as a broker-dealer, markets you a monetary item, she or he obtains a details portion of the sale quantity. Some monetary experts who benefit large brokerage firms, such as Charles Schwab or Integrity, obtain a wage from their employer. Whether you need a financial consultant or otherwise depends upon just how much you have in assets.

Report this page